In Conversation with Amit Vadehra

Paramjot Walia

Established in 2006, CRAYON CAPITAL today is one of India’s leading Art Advisory Services companies, providing wide range of services in the Indian Art Market. Crayon Capital played a key role as Art Advisor to some of the largest and leading Art Funds in India and abroad, thus contributing towards the development of Indian Art Market globally. Crayon Capital has been advising India’s top collectors and Industrial houses on building high quality collection of artworks of India’s leading Modern and Contemporary artists. Paramjot Walia in conversation with Amit Vadehra , co founder of

Crayon Capital Art.

Art&Deal : How did you come to be an art advisor?

Amit Vadehra: Well, my father used to buy art from the gallery upstairs. That time art wasn’t that fancy, it could be bought in just few lakhs. Because of close proximity to art, Gaurav and I always had an interest in it. Generally speaking, we already had a business idea and we wanted to inform people about art. Gaurav and I connect at all levels so it was easy for us to engage and start a business together as we have similar thought process.

AD: Art primarily as an investment vehicle or as a source of aesthetic value and pleasure. Please comment.

AV: It is necessary for a work of art to have aesthetic value. If you like a work it might as well be of good investment value, that is the basic point. If there is a choice between two similar works and one is of more value than the other then we would recommend the one which has higher value. When the art bug bites you, you would start investing or should I say liking it and once you start buying you would automatically develop interest and value the aesthetics more than its investment value.

AD: What is the biggest misconception about art these days?

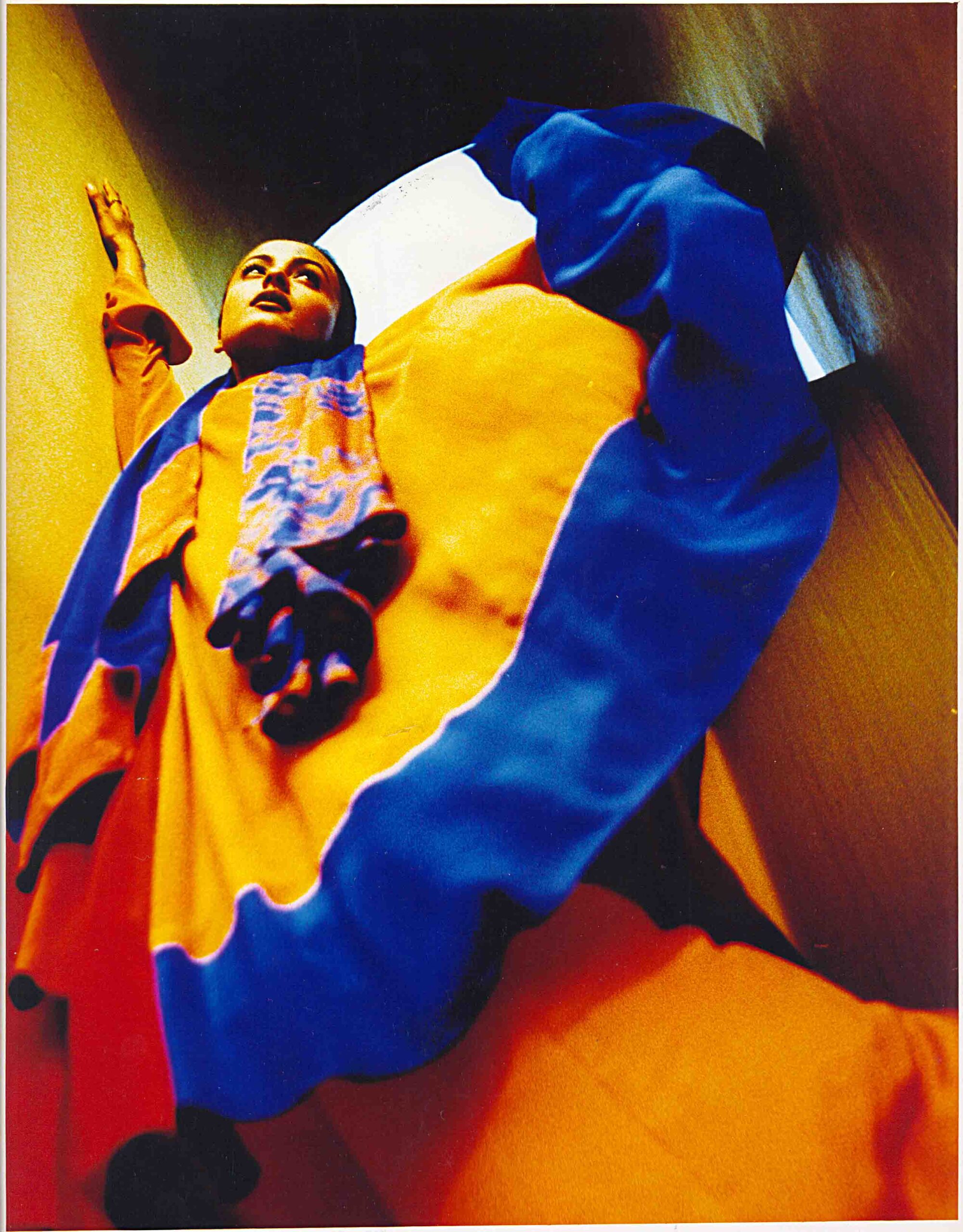

AV: Misconception..Well one question which everyone asks is if we could recommend any young artist who would do very well in the coming years .So the biggest misconception, even though we are coming from investment side, is that every art you buy would turn into gold .People expect that from us. For instance a message would come from a client saying “I have five lakhs, which artist should I buy right now so that it becomes fifty lakhs in coming years.” It doesn’t work like that, if life was so simple I would be a billionaire. Clearly the misconception is that every artwork is of investible value. Good part about art investment is even if value goes up and down you Goddess riding by M.F. Husain Head by F.N.Souza still have it on your wall, you could still enjoy and appreciate it and later pass it on to your next generation. So basically there are two misconceptions; First misconception: Art is purely an investment and second misconception is that whatever art one buys it has to grow in value tomorrow.

AD: Can you share how you usually work with your clients? How do you find the art and how do you connect the clients with the art?

AV: Art community is extremely small, it should have been thousand times bigger than this but it is very small, so everyone knows everybody and art buyers get to know you through word of mouth. Once you have been in the industry for long, events get covered and written about. We are a very different model from any other gallery, a regular gallery works directly with the artist but we work on the secondary market model .If you want a particular artwork/artist I would source that for you through my network of galleries, auction houses and private clients. For instance one client came to us and wanted a particular Manjeet Bawa work of a particular style. It took us about two/three years to locate that as it is not easily available .For artwork for hotels and houses, we actually take the artworks to their house and show it up in different spaces. Everyone has a different requirement and a different thought process for acquiring art.